The modernisation of a national payment system is no longer a question of ‘if’, but ‘how’. For the leaders of clearinghouses and central banks, success hinges not on simple vendor selection, but on choosing the right architecture and a proven playbook. The mandate is clear: build a system that is secure, interoperable, inclusive, and can be deployed with certainty. This is the definitive blueprint for achieving that mandate. It outlines the core principles of a modern Payment Switch architecture and provides a step-by-step guide for any institution tasked with building the future of its nation’s finances.

The Mandate: Defining the ‘Why’ Before the ‘How’

The impetus for Clearinghouse Modernisation stems from a convergence of powerful economic and social forces. The inefficiency of legacy systems, which trap value in institutional silos, acts as a direct impediment to GDP growth. In a digital-first economy, the demand for instant, seamless Real-Time Payments (RTP) is non-negotiable for consumers and businesses alike. This modernisation is a foundational step towards greater Financial Inclusion, creating accessible pathways for millions to enter the formal economy by lowering barriers and simplifying the user experience.

The Transfiya project in Colombia serves as a powerful case study in executing a clear mandate. The objective set forth by ACH Colombia was precise: build a new national payment system that could unify a fragmented ecosystem, deliver 24/7 reliability, and be simple enough for mass adoption. This clear goal became the guiding principle for every architectural and strategic decision that followed. It proved that a well-defined mandate is the essential first step in a successful national rollout. It creates the framework for a successful partnership, ensuring that the resulting Central Bank Infrastructure is a tool for achieving specific national economic goals, from increased payment velocity to broader citizen participation in the digital economy.

Core Architectural Principles of a Modern Payment Switch

A modern payment system is defined by its architecture. A modular, cloud-native Payment Switch architecture offers a level of agility, scalability, and security that monolithic, on-premise systems cannot match. The core principles of this modern approach are fundamental to its success and provide a clear answer to the question of how to build an RTP network that is fit for the future.

- The Immutable Ledger: The Foundation of Trust At the heart of a modern system is an

Immutable Ledger. This is a central, cryptographic book of record that provides a single, unchangeable source of truth for every transaction. Every state change is a signed, auditable entry, which eliminates settlement risk and the costly, time-consuming process of manual reconciliation. This architectural choice is the foundation of a trusted system, providing absolute certainty and transparency to all participants. AnImmutable Ledgeris the ultimate guarantee of data integrity, a non-negotiable requirement for criticalCentral Bank Infrastructure. - The Two-Phase Commit: Guaranteeing Finality To ensure transactional integrity without compromising speed, the architecture utilises a

Two-Phase Commitprotocol. An ‘Intent’ acts as a pre-authorisation, while a ‘Claim’ is the final, signed confirmation that executes the irrevocable ledger update. This process creates a critical, automated window for security and compliance checks to occur before funds are settled. It provides the real-time clearing finality of a gross settlement system while enabling the liquidity efficiencies of a net settlement model. This protocol-level detail is essential for building a robust and securenational payment system. - The Bridge Protocol: The Key to Interoperability Achieving true

Interoperability in Paymentsis the primary challenge of any national system. A modern architecture solves this with a Bridge Protocol. This component acts as a universal translator, connecting the new ledger to the legacy cores of traditional banks and the closed-loop systems of digital wallets. It ensures that no participant is left behind due to their existing tech stack, removing the need for a traumatic “rip and replace” of functional, existing systems. This is the pragmatic path to unifying an entire ecosystem and achieving genuine network effects. - The Alias Directory: The Engine of Mass Adoption Finally, technology must serve the user. The Alias Directory is a critical layer that solves the user experience problem that often hinders the adoption of new payment systems. By replacing long, complex account numbers with simple, memorable aliases like a mobile phone number, it removes friction and makes instant payments intuitive for everyone. This component was a key driver of Transfiya’s success, proving that a focus on user experience is essential for achieving the national goal of

Financial Inclusionat scale.

The Partnership Blueprint: De-Risking National Deployment

A successful national deployment is as much about the partnership model as it is about the technology. The most effective model for ACH modernization leverages the unique strengths of each party to de-risk the entire project and accelerate the path to a live, functional network.

- Minka’s Role: The Engine for Growth As the technology partner, Minka delivers the core architecture, the

Payment Switch architectureand its modular components. Crucially, Minka also provides a comprehensive ecosystem acceleration program. This includes dedicated frameworks for rapid participant onboarding, deep technical integration support, and a formal certification service. This structured program ensures that every bank and fintech can connect to the newCentral Bank Infrastructurequickly and securely, guaranteeing the integrity of the network from day one and fostering a collaborative environment. - The Partner’s Role (Clearinghouse/Central Bank): The Mandate The clearinghouse or central bank provides the market mandate, the established trust of the financial sector, and the regulatory legitimacy. They are the conveners, bringing all major financial institutions to the table and ensuring the new

national payment systemaligns with national policy goals and compliance frameworks. They own the scheme, the rules, and the relationships; Minka provides the engine.

This clear division of roles transforms a high-risk technology migration into a low-risk business upgrade for every participant. It creates a model where all stakeholders are aligned towards the common goals of growth, security, and Interoperability in Payments.

Clearinghouse Modernisation in Action: From Pilot RTP Network to National Adoption

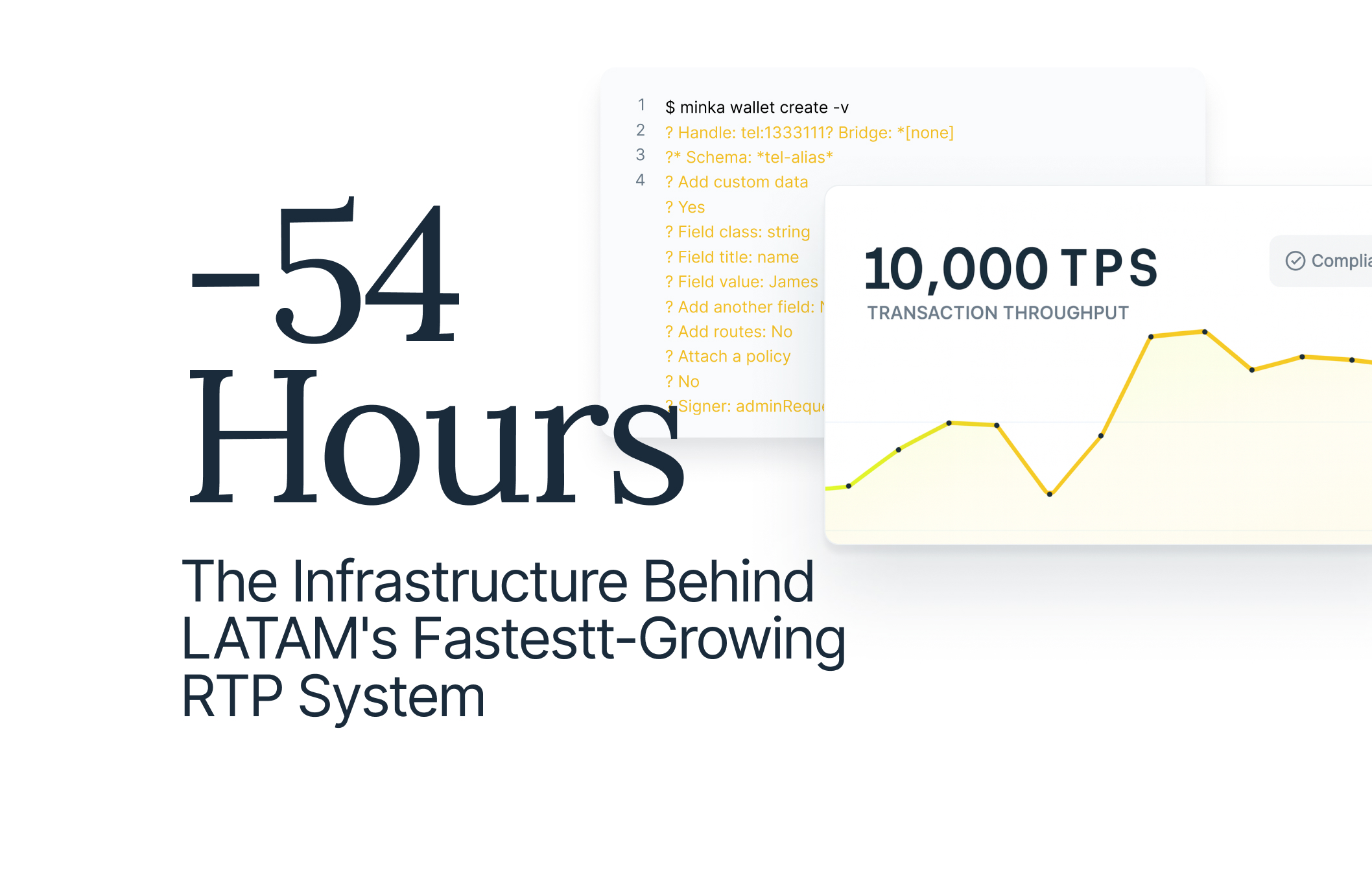

The strategic advantage of a modern, cloud-native architecture is the speed of deployment. A Clearinghouse Modernisation project can be executed in months, not years. This accelerated timeline is a direct result of a pragmatic, API-driven approach that avoids the pitfalls of legacy system overhauls.

The implementation is a phased, agile process. It begins with the deployment of the core ledger and the connection of a few pilot institutions via the Bridge Protocol. This allows for rapid testing and iteration in a live environment, building confidence and momentum. As more participants are onboarded and certified through the acceleration program, a powerful network effect takes hold. The growth metrics from Transfiya serve as hard proof of this model’s effectiveness: scaling from a few thousand Real-Time Payments (RTP) a month to over 42 million demonstrates the immense capacity of the architecture. This rapid, predictable deployment model is the ultimate differentiator for any institution wondering how to build an RTP network that can deliver immediate value to the national economy.

Legacy vs Modern Financial Infrastructure: A Comparative View

| Dimension | Legacy Payment Systems | Modern Payment Switch Architecture |

|---|---|---|

| Deployment & Timelines | Multi-year implementations with costly consulting and on-premise hardware. | Cloud-native, API-driven rollout in months, not years. |

| Scalability | Rigid, fixed capacity requiring major upgrades to handle growth. | Elastic cloud-native payment switch scales instantly to millions of real-time payments (RTP) per second. |

| Cost Structure (TCO) | High upfront CAPEX, expensive maintenance, hidden costs from delays. | Predictable, lower total cost of ownership payment infrastructure with PaaS model and faster ROI. |

| Interoperability | Limited; siloed systems with complex integrations. | Modular Infrastructure with universal Bridge Protocol, enabling seamless interoperability in payments. |

| Standards & Compliance | Painful migrations; requires translation layers for standards like ISO 20022. | Native ISO 20022 migration support with richer data and seamless compliance. |

| Innovation Speed | Vendor lock-in, slow upgrades, limited flexibility. | API-Driven Financial Infrastructure that accelerates ecosystem innovation and fintech growth. |

| Financial Inclusion | High barriers for users and institutions; limited reach. | Low-friction onboarding, Alias Directory, and mobile-first UX driving mass financial inclusion. |

| Resilience & Security | Dependent on fragmented legacy fraud tools; batch-based risk checks. | Immutable Ledger with two-phase commit ensuring settlement finality and real-time fraud prevention. |

The modernisation of a national payment system is one of the most consequential infrastructure projects a nation can undertake. Success requires a clear mandate, a superior architectural philosophy, and a proven partnership model. This blueprint, built on the real-world success of Transfiya, provides a de-risked, accelerated path for any clearinghouse or central bank ready to build the foundational rails of a modern digital economy. The technology, the strategy, and the proof now exist.