At the ELOCC 2025 conference, one theme dominated: the future of clearinghouses. For more than a century, they have been the silent backbone of financial systems, ensuring that transactions were cleared and settled at the end of each day. This role was sufficient when batch settlement matched the speed of the economy. But the reality of today’s digital, real-time markets has changed expectations completely. The event made clear that clearinghouses now stand at a crossroads. They must modernise into dynamic, open platforms, or risk being left behind as faster systems emerge around them.

The Past: Trust in a Closed World

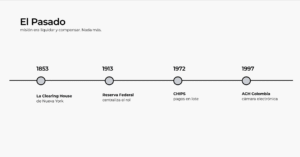

Clearinghouses were originally designed to build trust among banks. The New York Clearing House in 1853, the creation of CHIPS, the rise of ACH in the 1970s, and the centralisation by the Federal Reserve all served the same purpose: to provide reliability and predictability. They worked by processing transactions in batches, a method that was efficient for its time but carried built-in limits.

Because settlement happened only once or twice a day, capital sat idle, creating liquidity traps for businesses and delaying access to wages for workers. The closed architecture made it almost impossible to integrate new players quickly, and the systems were built for stability rather than adaptability. ACH modernisation initiatives showed how difficult it was to retrofit speed into a structure designed for delay. The mandate of trust was met, but the mandate of a real-time economy was not.

The Present: The Real-Time Imperative

The present has been defined by the global move to Real-Time Payments (RTP). In Colombia, Transfiya, built on Minka’s cloud-native infrastructure with ACH Colombia, proved that a clearinghouse could be transformed. It scaled to more than forty million monthly transactions, achieved five-nines availability, and became a network that connected banks, cooperatives, and wallets in real time. In Brazil, Pix became the benchmark for a central bank-led system, with near universal adoption and extensions into e-commerce, NFC, and scheduled payments. Even in the United States, the Federal Reserve launched FedNow in 2023, acknowledging that the largest economy in the world could not afford to remain dependent on batch systems.

The economic results are visible. Businesses that can pay suppliers instantly operate with tighter, more efficient working capital. Employees who receive wages on payday morning, not three days later, enjoy immediate liquidity. Governments that use instant payment networks distribute aid faster, with full audit trails and reduced fraud. What was once considered innovation is now the minimum requirement. A system that is not real time is no longer modern, it is a liability.

The Future: From Utility to Standard

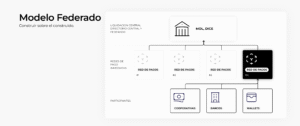

At ELOCC, the conversation about the future focused on the federated model. Instead of functioning as isolated batch utilities, clearinghouses can evolve into open standards for national and regional economies. This model rests on three practical components: a central ledger that acts as the book of record, a directory of aliases that simplifies user experience, and open APIs that allow any authorised participant to connect.

The point is not to replace existing systems but to connect them. Banks, cooperatives, digital wallets, and fintechs can all operate on the same rails without losing their independence. For this to work, public-private partnerships are essential. Clearinghouses and central banks provide the trust and regulatory framework. Technology partners such as Minka bring the Payment Switch architecture, reconciliation tools, monitoring, and fraud prevention that make the system scalable and secure.

When this transformation happens, new use cases follow naturally. Payroll and supplier payments move in real time instead of through batch files. Merchants, from large retailers to small shops, accept QR and NFC payments instantly, reducing reliance on cash and creating valuable transaction data. Governments distribute subsidies at scale with immediate settlement and full transparency. Cross-border connections between modernised clearinghouses open new corridors for trade and remittances. These are not theoretical scenarios; they are already operating in networks like Transfiya and Pix, and they can be replicated in other regions.

The European Angle: SEPA Instant Connectivity

Europe offers a clear example of both progress and challenge. SEPA Instant (SCT Inst) has set the benchmark for credit transfers within ten seconds, available all year round. For consumers, this has created a new normal. For institutions, however, the road to direct SEPA Instant Connectivity is complex. Smaller banks, PSPs, and EMIs often depend on sponsor banks to access clearing and settlement mechanisms like RT1 or TIPS. That creates dependency, cost, and long integration cycles.

The European Central Bank has been clear that wider adoption of SCT Inst is a policy goal, but technical and commercial barriers remain. Not all PSPs can justify the investment in direct connectivity, and sponsor bank arrangements often limit product innovation. This creates a fragmented experience for end users and slows the pace of competition.

Here, lessons from Latin America are relevant. A Modern Clearing Infrastructure, designed with modular payment switch components and open APIs, can act as a gateway to SEPA Instant. It can handle the complexity of ISO 20022 messaging, compliance, and settlement behind the scenes, allowing participants to connect quickly and focus on delivering new products. This approach would allow European Clearinghouses to play an enabling role: extending SCT Inst access more broadly, accelerating adoption, and creating a level playing field for smaller institutions.

For European Clearinghouses, the choice is similar to that highlighted at ELOCC: continue as restricted access points, or transform into platforms that democratise instant payments for the entire ecosystem.

Security and Reliability

None of this matters without security and reliability. National payment infrastructure must offer certainty. Minka’s deployments demonstrate how this can be achieved. An immutable ledger records every transaction permanently, providing a full and tamper-proof audit trail. A two-phase commit process, based on intents and claims, ensures that every payment is validated before final settlement, giving space for fraud checks without slowing the system. A cloud-native architecture built on microservices provides elasticity, proven to scale beyond 10,000 transactions per second with 99.999% uptime. More than 700 million transactions have been processed in live networks without systemic fraud. These are the kinds of results that define enterprise-grade infrastructure.

Conclusion

The conclusion from ELOCC 2025 was clear: the time of the clearinghouse as a passive settlement utility is over. The new role is to become an open payment standard that connects the entire economy. The blueprint already exists in live systems. The technology has been proven. The benefits, from liquidity gains to financial inclusion, are measurable.

For clearinghouses in Latin America, in Europe, and worldwide, the decision is straightforward. Modernise now, or risk being bypassed by parallel systems. The opportunity is to lead the future of payments by adopting Clearinghouse Modernisation, investing in Interoperability in Payments, and building Public-Private Partnerships in Fintech. The examples of Transfiya, Pix, FedNow, and SEPA Instant show that this future is already here. The question is who will build on it.

Discover how a modern clearing infrastructure can redefine your role. Schedule a strategy session with our infrastructure team.